However, they differ in terms of their operation and their roles within financial strategies. To effectively manage these two categories of payables, clear and detailed expenditure records are crucial; otherwise, it may impact their ability for strategic financing and even pose potential financial risks. This article provides a detailed introduction to the differences between accounts payable and notes payable, and how SMEs can leverage the bill payment features of quick payment accounts to manage their finances more efficiently and easily.

Accounts payable refers to the short-term liabilities that a company incurs after purchasing goods or services from suppliers, typically to be paid after receiving the goods or services. This amount usually needs to be paid within 30 or 60 days and is listed as a liability on the balance sheet. Accounts payable is an unavoidable financial responsibility in the daily operations of a business, and timely management and payment of these payables help maintain good relationships with suppliers and avoid default risks.

For example, a retail store selling hygiene products orders a batch of new masks from a factory. Both parties agree that the payment will be made to the mask manufacturer only after the goods are received. During this process, the hygiene product store will record this accounts payable on its books, indicating that they need to pay the relevant amount to the mask manufacturer. This amount typically needs to be paid within a specified period, such as 30 or 60 days.

Accounts payable refers to the short-term liabilities that a company incurs after purchasing goods or services from suppliers, typically to be paid after receiving the goods or services. This amount usually needs to be paid within 30 or 60 days and is listed as a liability on the balance sheet. Accounts payable is an unavoidable financial responsibility in the daily operations of a business, and timely management and payment of these payables help maintain good relationships with suppliers and avoid default risks.

For example, a retail store selling hygiene products orders a batch of new masks from a factory. Both parties agree that the payment will be made to the mask manufacturer only after the goods are received. During this process, the hygiene product store will record this accounts payable on its books, indicating that they need to pay the relevant amount to the mask manufacturer. This amount typically needs to be paid within a specified period, such as 30 or 60 days.

Many people may think that accounts payable and notes payable can be used interchangeably in definition, but that is not the case. The table below clearly summarizes the differences between the two:

| Account payable | Note payable | |

| Definition | Short-term debt incurred by a company from purchasing goods and services from its suppliers. | Long-term debt that a company pays to its suppliers or lending institutions. |

| Time | Repayment is due within 30 or 60 days after receiving the goods. | Typically has specific terms and periods, classified as short-term (one year or less) or long-term (more than one year). |

| Interest/ Collateral | No interest is charged, and early payment discounts may be offered. As a short-term loan, no collateral is required. As long as invoices are paid on time, suppliers will continue to provide services. | A written promise must be signed as a guarantee of the repayment terms. The note includes the principal amount issued by the lender, interest payable, payment schedule, collateral, and its terms. This information is all incorporated into a formal lending agreement between the borrower and the lender. |

As mentioned in the table above, a company's long-term notes payable (Long Term Note Payable, abbreviated as LTNP) refer to notes payable with a term of more than one year, which are part of the company's liabilities and primarily arise from long-term loans or financing arrangements.

For small and medium-sized enterprises (SMEs) that are profitable and can adhere to repayment terms, obtaining operational funds through long-term notes payable allows them to secure the necessary working capital and enjoy longer repayment periods (ranging from 12 to 30 months). This provides a flexible way to control capital expenditures and effectively achieve growth in the short term.

If SMEs fail to properly record accounts payable and notes payable, it can lead to several negative consequences, including:

- Difficulty in fund management

If a business does not accurately record its accounts payable and notes payable, it may struggle to control its cash flow, potentially leading to financial risks, such as being unable to pay suppliers on time, which can affect the company's operations and reputation.

- Impact on account accuracy

A lack of proper records for accounts payable and notes payable can create confusion in the company’s accounts, thereby reducing the accuracy and reliability of financial statements, which impacts financial analysis and decision-making.

- Potential default risks

Failing to accurately record payables can result in missed payments to suppliers, increasing the risk of default. This may negatively affect the relationship between the business and its suppliers, and the company may face legal actions or other legal issues.

- Missed discount opportunities, leading to increased costs

Not recording payables in a timely manner may cause the company to miss opportunities for early payment discounts, meaning the business ends up paying more than necessary, which leads to increased costs.

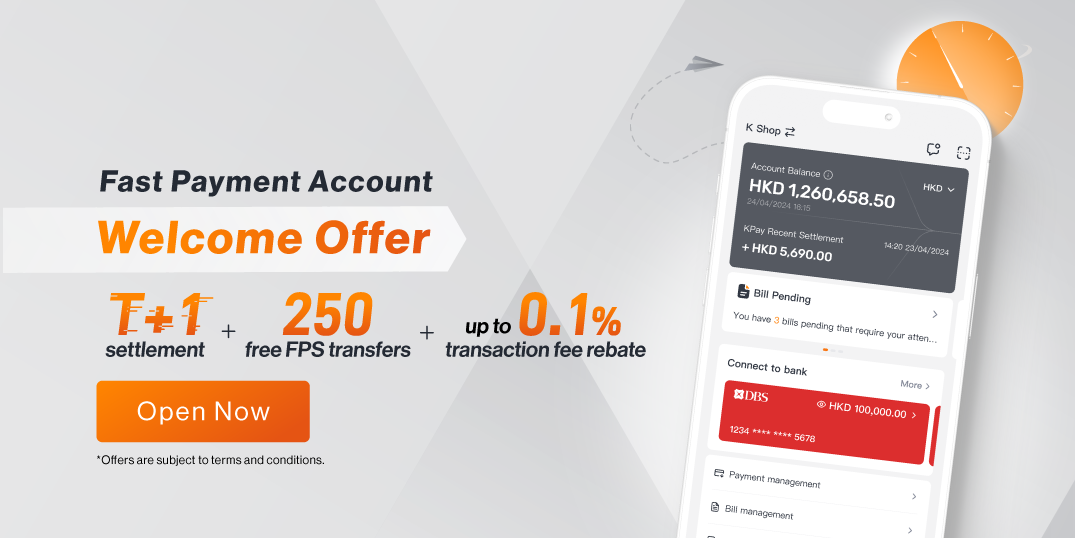

Is managing accounts payable and bill management tedious and time-consuming? Traditional methods are not only prone to errors but could also waste you up to 480 hours a year, equating to a loss of HK$33,600! The new KPay Fast Payment Account allows you to easily manage all your business bills and invoices digitally through the KPay App, streamlining everything from approval and payment to analysis in one place. While improving bill management efficiency, you can also enjoy limited-time welcome offers to accelerate your business growth at a lower cost!

4 Major limited-time welcome offers:

- T+1 Express Settlement

- First 250 HKD FPS transactions free (worth HKD 1,250)

- Up to 0.1% rebate on Visa and Mastercard transactions

- Unlimited local transfer discounts

Click 'Started now' below to connect with us and learn more!