All-in-one payment solution

for businesses of all kinds

Online Payment

Online Payment

Accept payment on your website or app for your eCommerce business.

Invoice Payment

Invoice Payment

Digital invoice with built-in payment options for you to receive payments in minutes.

Payment Link

Payment Link

No-code method to receive payments by simply creating a link.

Buy Now Pay Later

Buy Now Pay Later

Allow your customers to pay in flexible instalments.

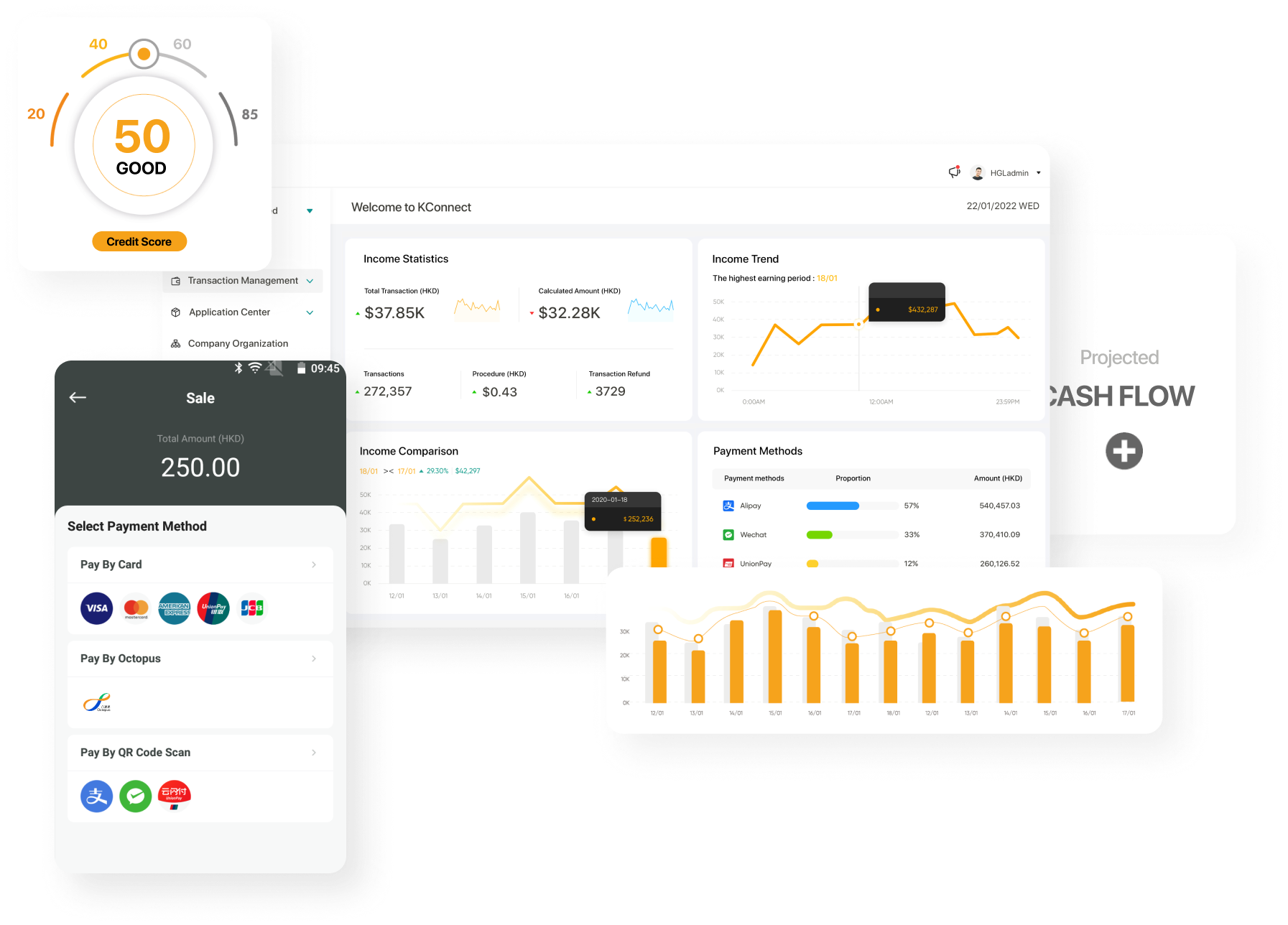

Smart Pos Terminal

Smart Pos Terminal

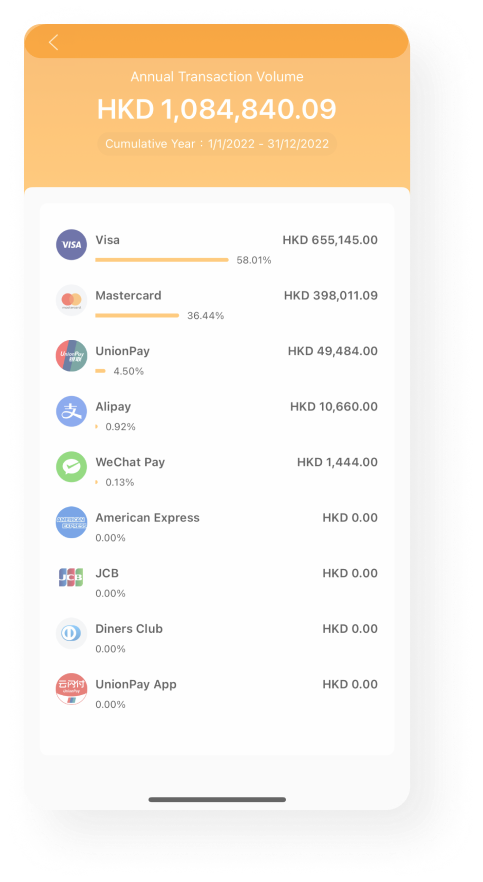

Accept up to 15 payment methods in-person with our smart POS terminal.

Explore more

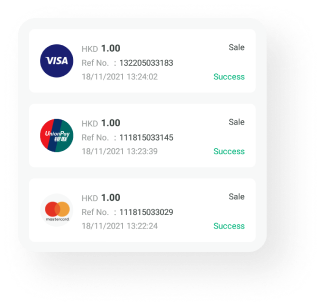

mPos

mPos

Accept payment anywhere with just a mobile device.

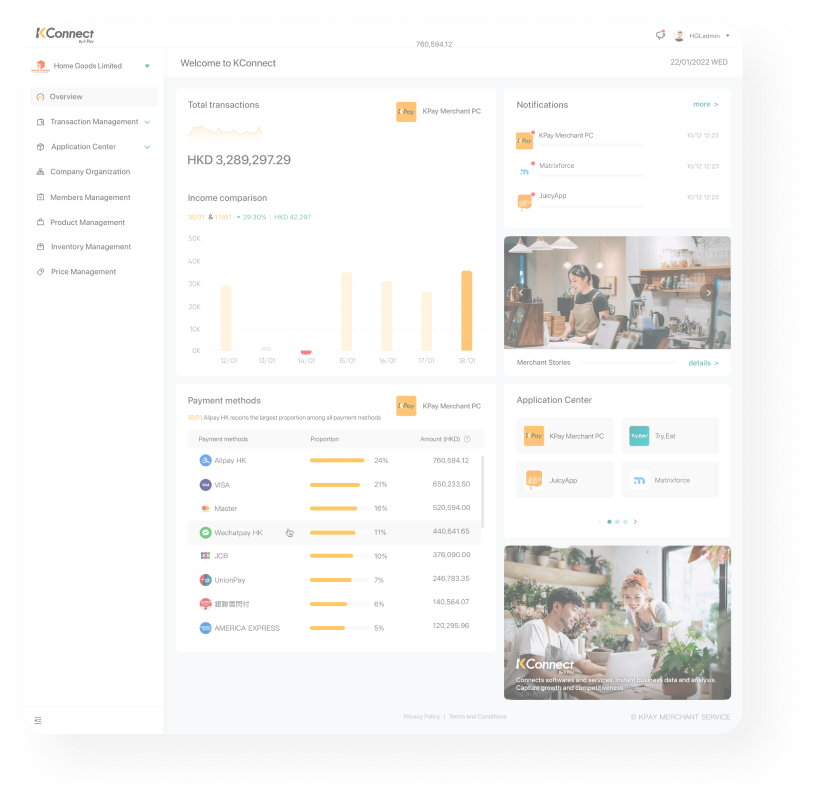

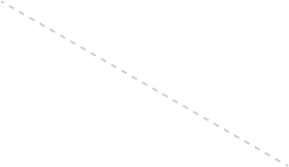

Standardising business data

Enhancing operations efficiency

Our one-stop merchant operations management platform unifies sales and operational data, together with a suite of curated SaaS software and services.

Capture instant growth

with fast & easy funding solution

Revenue-based financing solutions designed to help SME businesses secure growth capital.

Merchant Stories

Why KPay?

To bridge the gap between

technology and business growth

KPay empowers businesses to operate effortlessly and without distraction, allowing them to focus entirely on their growth and delivering value to their customers.

25,000+

merchants

3X

year-on-year merchant growth

100+

business sectors served

Accelerate your growth with KPay now

Contact our sales team for a customised solution for your business.